Fund Your Account

Whether you're rolling over old employer plans, or transferring an existing IRA, we have plenty of funding solutions to fit your needs.

Start Investing!

Start buying, selling, and owning Gold & Silver inside of your Retirement Account as soon as your account is funded. Let's get started!

Why limit your savings to Paper Products?

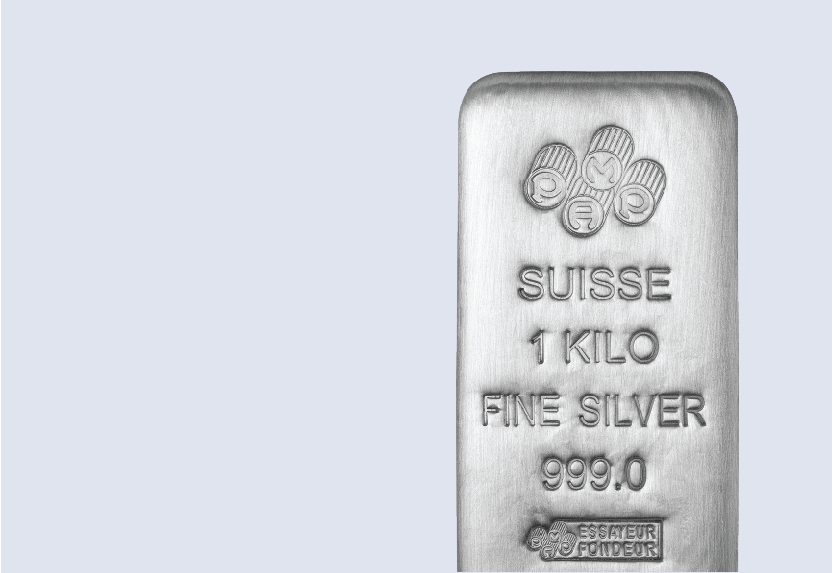

Unlike most retirement accounts that offer only paper investments, a Self-Directed IRA allows you to mitigate your exposure to dollar denominated assets by holding alternative asset classes inside your account. Precious Metals are vaulted, & fully insured up to $1 Billion Dollars with an all-risk insurance policy. The depository does not have any debt & does not lend any metals in it's storage, meaning your metals are fully allocated at all times.

Frequently Asked Questions:

How long has All American Assets been in business?

All American Assets has been in business since 2007.

Is All American Assets accredited by the BBB?

Yes, All American Assets is accredited by the BBB with an A+ rating.

Is All American Assets licensed and insured?

Yes, All American Assets is licensed, bonded, and insured.

What types of precious metals do you sell?

We offer IRA approved gold, silver, platinum, and palladium bullion bars, coins, and rounds.

Do you offer both bullion and numismatic coins?

No, we deal exclusively in bullion. Rare or numismatic coins are valued subjectively based on what someone is willing to pay, rather than on their actual metal content.

Do you offer storage accounts or precious metals IRAs?

Yes! We are a full-service precious metals firm; so we offer services for physical delivery, storage accounts, and IRAs.

How Much Does It Cost To Rollover My IRA into Gold & Silver?

The Process Doesn't Cost Anything.

It is a Tax Free, Penalty Free, Fee Free Rollover.

We make money only when you buy Gold & Silver.

Are There Any Fees For A Gold IRA?

There are custodial fees, but the are very affordable & often times cheaper than your current 401k or IRA plan.